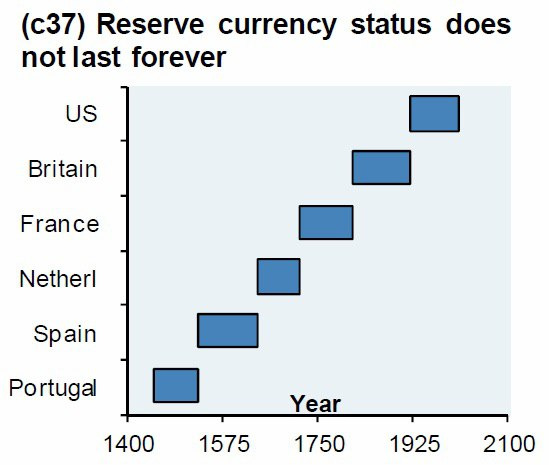

I would not overly focus on what will happen in 100 years, the global reserve currencies of the last 600 years barely lasted as much. It may sounds a little bit irresponsibe but I would let future generations deal with it in the way they seem appropriate

Imo the mindset should be more “what’s the most appropriate economics for Nimiq to be considered a legit currency by 2025-2030?”.

I also agree with @Chugwig on fees, fees are the embedded incentive to secure the network, we want very very low fees but still enough so the network is as robust as possible. I think a feeless model is fundamentally flawed in terms of game theory for this reason: there is no hard coded incentive to secure the network and you rely on things like “goodwill” which are not really rigorous.

That said if we are moving to the topic of governance with voting inflation then the next topic should be voting the maximum supply too.

I’m personally open to hear the pros and cons of such an idea even though I am not sure if having a democratic management of the supply (with all its pitfall and instability) would be better than just leaving the protocol alone (even though we would likely end up with a conservative majority).

It would be quite radical if Nimiq followed this path though and probably be called out for recreating fiat in a way, NIM would be much “softer” as a currency compared to a Bitcoin which is hard money and as immutable as possible

I read an interesting medium post related to that question btw:

Here is the conclusion:

I believe that cryptocurrencies offer a unique opportunity to engineer long term monetary policy that is carried out in full transparency. Unfortunately, many protocols we’ve looked at do not take advantage of this opportunity, or are prone to change (which defeats the purpose).

Other than fluid monetary policy, another noteworthy trend is the steeply front-weighted nature of most distribution plans. In other words, more opportunity for early adopters to acquire a larger percentage of the total supply (assuming a similar or greater amount of economic throughput going forward). The intensity of this varies depending on each protocol’s preference for hardness in their native currency.

I wonder how future generations will feel about this? Will they resent the early adopters for having an “unfair” advantage, or will they admire the hard money that comes along with low inflation. Only time will tell.