Albatross - An optimistic consensus algorithm

Nimiq Foundation & Trinkler Software (Vol.3, 2019)

Abstract—The area of distributed ledgers is a vast and quickly developing landscape. At the heart of most distributed ledgers is their consensus protocol. The consensus protocol describes the way participants in a distributed network interact with each other to obtain and agree on a shared state. While classical consensus Byzantine fault tolerant (BFT) algorithms are designed to work in closed, size-limited networks only, modern distributed ledgers – and blockchains in particular – often focus on open, permissionless networks. In this paper, we present a novel blockchain consensus algorithm, called Albatross, inspired by speculative BFT algorithms. Transactions in Albatross benefit from a strong confirmation, and instant confirmations can be achieved as well. We describe the technical specification of Albatross in detail and analyse its security and performance. We conclude that the protocol is secure under regular PBFT security assumptions and has a performance close to the theoretical maximum for single-chain Proof-of-Stake consensus algorithms.

Read the full Albatross paper here: https://katallassos.com/papers/Albatross.pdf

Additional reading on Proof-of-Stake: https://github.com/ethereum/wiki/wiki/Proof-of-Stake-FAQs

Additional reading on CASPER (Ethereum): https://github.com/ethereum/wiki/wiki/Casper-Proof-of-Stake-compendium

Whilst we don’t know the full ramifications of what Albatross entails for Nimiq (yet), there are a number of interesting discussions to be had. Discuss!

To structure discussions there will be a numbering system put in place for each topic. If you have questions / discussion points to add to the list please comment!

Questions & Discussion points

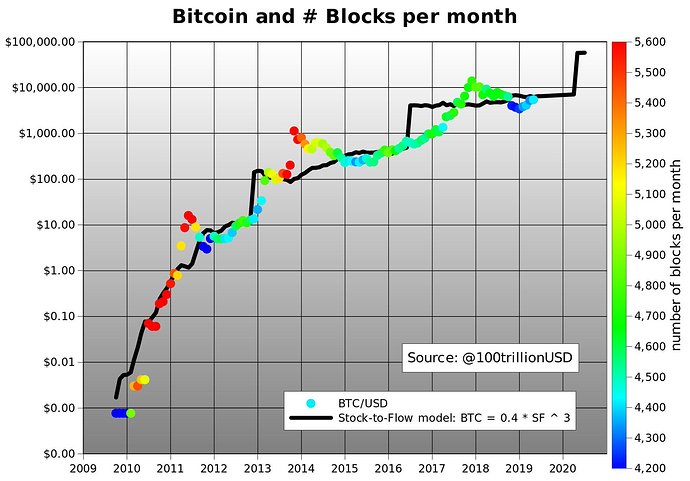

- Does PoW inherently give a coin value or does the utility attached to the coin give it value?

- Proof-Of-Stake (PoS) as an economic model that makes the rich, richer, and the poor, poorer.

- In a PoS system, no capital is at risk which is the opposite of Proof-of-Work (PoW).

- Decentralisation: PoS vs PoW

- Question on Delay attacks by @kenblazer

):

):